Choosing a mutual fund and why we like Parag Parikh Flexi Cap

Mutual funds pool money from various investors and invest in stocks, bonds, or other securities. The main objective of these funds is to help investors build wealth over a period of time.

The Indian mutual fund industry has 44 AMCs in total offering a plethora of schemes and catering to all types of investor needs. However, choosing the right scheme based on the investors’ needs can be challenging, since there are too many options available in the market.

The main objective of mutual funds is to simplify the process of investing. But it’s unfortunate that with increased demand and huge competition in the market, AMCs are flooding the market with new fund offers (NFOs) every now and then. What can a humble investor do to pick from so many funds?

But there is one AMC PPFAS (Parag Parikh Financial Advisors), that has launched only 4 funds to date. Their flagship flexicap fund (formerly known as long-term equity fund) has gained a lot of traction from the investors.

In this article, we try to understand things an investor has to look for before deciding on investing in a mutual fund. We will then get into the details of why we like Parag Parikh’s Flexicap fund, its management, and its investing philosophy.

Before reading further, do consider subscribing to our newsletter so that you won’t miss out on any such insights around investing and Indian stock markets. Thank you for your support :)

So let’s get started...

About the fund:

As part of reading books on investing, we read Legendary Mr. Parag Parikh’s “Stocks to riches”. The book had great insights on aspects of behavioral finance and Parag Parikh’s interactions with customers in his more than a decade of experience as a sub-broker.

He is considered a value investing guru in India and had written another book called “Value investing and behavioral finance”. He later gave up his license to start an AMC in his name.

In 2015, unfortunately, he passed away in a tragic car accident at the age of 61 when he went to the US to attend Warren Buffet’s annual shareholders’ meeting of Berkshire Hathaway.

Parag Parikh’s Flexi cap fund can be called a “Go anywhere” fund because this fund has the flexibility to invest in Indian and foreign companies irrespective of market capitalization and sectors. Flexicap funds must invest 65% of total assets in Indian equities.

This is a local fund with a Global focus and it has global advantages without tax disadvantages. Because an average of 65% of its corpus is invested in listed Indian equities, which it benefits from the favorable Capital Gains tax treatment.

Scheme Details:

Launched on May 28, 2013.

Fund Managers: Rajeev Thakkar looks after Indian equities whereas Mr. Raunak Onkar looks after foreign equities. One good aspect is the same fund managers are managing this fund from its inception. It ensures consistency in the style of investment.

AUM as of Dec 31, 2021 – 19933.09 crores

Holding of 'Insiders' (Management)- 283.763 Crores of AUM as of December 31, 2021. It is 1.46% of the total AUM.

Expense Ratio: Direct plan – 0.81% & Regular Plan – 1.80%

Minimum application amount – 1000

Annual Turnover - 10%

Exit Load – 2% for redemption within 365 days, 1% between 366 – 730 days

Benchmark Index – NIFTY 500 (TRI)

Total number of stocks in the portfolio – 27 (22 Indian stocks & 5 foreign stocks)

Top 5 Indian stock holdings:

5 Global Stock holdings:

Returns:

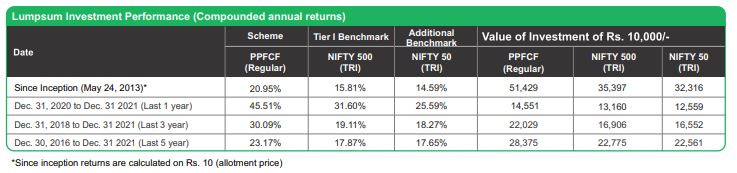

As per Dec 21 factsheet, the fund has generated 20.95% CAGR returns compared to its benchmark NIFTY500’s 15.81% and NIFTY50’s 14.59%.

The fund has managed to outperform its benchmark index (Nifty 500 TRI) by generating a higher alpha in the last 1yr, 3yr, and 5yr periods.

₹10,000 invested in the fund on May 24th, 2013 would have become ₹51,429 if you invested in the fund through a regular plan (MF distributors).

Mutual fund investments made through direct plans have a lesser expense ratio cutting down the commission taken by distributors and enhancing the returns further.

These returns are calculated in terms of CAGR. It is the average annual returns the fund has generated over a period of time. But CAGR returns do not give you a clear picture of the volatility. Consider an MF that was started 5 years ago. And the fund hasn’t performed well in the 1st 4 years since its inception.

But in Mar 2020, when the market crashed due to COVID, the fund has picked stocks like Bajaj Finance and Divis at very cheap valuations. Now the CAGR returns for the past 5 years may show that MF has generated good returns. But in reality, the fund got lucky in one year and spread the benefit to the past 4 years.

Rolling returns:

So how can an investor know how consistent the fund performed over the years? By calculating the rolling returns. They are annualized average returns for the selected period beginning from the 1st date to the last date. The returns are calculated every single day of the period and are then averaged.

Rolling returns provide an accurate and in-depth picture of the fund’s performance and its consistency across time frames, unlike the above example where one-year performance has painted a positive picture on the other 4 years. As a thumb rule, look for rolling returns when investing in an MF.

5 year rolling returns data Vs category and top 4 funds:

The return consistency of the top 4 funds in Flexicap and the category are mentioned in the below table.

Parag Parikh stands out in all key parameters.

But investment decisions should not be made based on the historical returns alone. Since risk is a crucial factor in any investment, let us also look at some risk measurement tools, to understand the fund in a better way.

Risk Measurement Tools:

We have taken 4 Flexi cap funds to do the comparison. According to ET Money, these are the 4 funds that top the list among its category.

Standard Deviation: It represents the volatility or riskiness of the fund. Lower the SD, lower will be the volatility and risk. PPFCF has an SD of 17.7, which is the lowest among the four.

Sharpe Ratio: It tells us if the returns generated are because of the wise investing decisions made by the fund managers or because of the excessive risk taken. Higher the Sharpe ratio, better risk-adjusted returns are generated. PPFCF has the highest Sharpe ratio among all.

Sortino Ratio: It estimates the excess return adjusted only for the downside risk. This ratio particularly helps the conservative investors who wouldn’t want to take a risk of losing money. Higher the Sortino ratio, the lesser the chance of down-side deviation. PPFCF has a Sortino ratio of 1.43.

Beta: It measures the relative risk of the mutual fund against its benchmark and doesn’t give an inherent risk. If the beta of a mutual fund is less than 1, then the fund is perceived as less risky compared to its benchmark. The beta value of PPFCF is 0.72, this is less compared to other funds.

Alpha: It tells us how much better the fund has performed when compared to its benchmark index. PPFCF ranks 2nd in generating an alpha of 13.44 after Quant, which has generated 15.53.

Therefore, we can conclude that PPFCF has generated higher alpha, has a high Sharpe Ratio, and a high Sortino ratio, which indicates the fund’s better potential performance. In addition to this, it has a low Standard Deviation and a low Beta which indicates a lower level of volatility in the fund.

Though some numbers if looked at in isolation suggest that PGIM is also worth looking at, things like PGIM having higher standard deviation compared to PPFCF shows us that the later will offer better risk adjusted returns.

We would like to thank Shankar Nath Sir at ET money. He and his team's videos on Youtube had a great impact on our understanding of mutual funds. We would suggest you all watch their Mutual funds for beginners playlist to learn and understand anything and everything about MFs in India.

How is PPFAS different from other AMCs?

Currently, PPFAS has only 4 schemes namely

Flexi cap fund,

Liquid fund,

Tax saver fund, and

Conservative hybrid fund.

PPFAS management follows a focused approach. They neither have too many schemes nor they are involved in other businesses like brokerage or distribution. They remain focused on Mutual funds and their work both effectively and efficiently.

PPFAS Investment Approach: Value Investing

The fund buys businesses that have low debt, high cash flows, investor-friendly management, competitive advantage, etc. It prefers buying stocks that are trading at a discount to their intrinsic value to create value for the investors. Avoids buying overvalued stocks. These are the filters that they look at before buying a business.

Key takeaways from the unitholders’ meet that they conduct every year to address unitholders:

Strongly believes in long-term investing. They have the patience to hold the stocks even if the stock price is stable for a long time, given that the business is growing as they wanted it to. This is reflected in their long-holding periods.

Skin in the game: Invests their own money in 3 out of 4 schemes except for the conservative hybrid fund. Moreover, they started investing their own money even before SEBI mandated the fund houses to invest.

Trust: Management focuses a lot on building trust. They don’t launch a flavor of the month scheme, no chasing of AUM, and have an open channel of communication.

Avoids new age IPOs, expensive or fancied sectors.

PPFAS doesn’t launch a new scheme out of FOMO. They would launch a new scheme only when they feel excited about it and feel confident in investing their own money.

They believe that it’s a profession rather than a mere business. They do what is in the interest of unitholders rather than chasing AUMs, top line, and bottom line.

A note on high AUM: Increasing AUM should not worry investors about the future returns because this is a Go anywhere fund. With a greater number of IPOs coming, with limited imposed restrictions on this type of fund, they do have higher flexibility in allocating the portfolio amount. Also, management says when they feel that higher AUM is becoming a problem, then without any hesitation, they are ready to stop taking more inflows into the fund.

What makes Parag Parikh Flexi cap fund different from other funds?

Reduces country risk: Most equity mutual fund schemes help investors diversify across industries within the same country. However, investors could still be affected if there are negative events throughout the country like a pandemic, drought, political turmoil, etc. Therefore, investing across countries will help in reducing this risk.

Wider choices: Several world-class companies do not have Indian subsidiaries that are listed. Also, there are innovative companies like Facebook, Google, Microsoft, etc., for which there is no Indian substitute.

Valuations: Sometimes, the Indian subsidiary of an MNC may be very highly valued, and hence not investment-worthy. But an advantage can be taken from its parent company, which can be available at a much more reasonable valuation.

This is one of the very few Indian mutual fund schemes that invest in a basket of Indian and foreign stocks.

Covered call strategy: Why does the fund do this?

Let us assume PPFCF has bought a stock assuming it will perform well. But if at all their investment thesis goes wrong and this stock does not give any returns or worse it might end up in a loss for the fund. So what can the fund do about this?

The fund implements a covered call strategy by selling call options of the same stock that it holds. Call options are a type of derivatives where you get into an agreement that the stock can be traded at a fixed price in that time period.

Here's a tweet thread by Kirtan A Shah to explain how the covered call strategy works for PPFCF.

So the fund can sell such call options on big positions that it holds to have downside protection and generate extra returns in the form of option premiums. In simpler terms, the fund is betting on the outcome of the stock price going up, being flat, and going down. If the price of the stock rises, the fund will lose some money. But if the price of the stock remains flat or falls further, the fund will make some money on these call options.

Conclusion:

Above all other good aspects about the fund, the biggest thing we like about the Parag Parikh Flexicap fund is its management and its value-based approach towards investing. Their great communication with unitholders is exceptional.

For instance, some key decisions of the fund like investing in ITC and using derivatives for covered call strategy led to a lot of unitholders questioning the intent of the management. They themselves came up with a questionnaire and answered unitholders on the website and their youtube channel.

I have seen most of the MF community getting disappointed with the “Skin in the game” rule by SEBi that mandated the fund’s management to have a stake in funds they manage. But Parag Parikh’s management held stakes even before this rule came into existence. They collectively held 1.46% of their total AUm i.e ₹283.763 Crores as of December 31, 2021. This speaks volumes about the management.

Though we generally believe that low-cost index funds are the best instruments for a common average investor to build wealth over time, if there is one active fund that we are comfortable holding for a long period of time, that would be the Parag Parikh Flexicap fund. We are currently invested and would like to continue our SIPs.

This write-up is for educational purposes and not investment advice. Do your own research before buying.

Happy Investing!

Peace,

May27 Capital.