About the company:

KPIT technologies provide mobility solutions to automotive companies across domains like Autonomous Driving, Connected Vehicles, Electric & Conventional Powertrain, Vehicle Diagnostics, and Mechatronics. It is the only embedded software company with deep domain expertise across the CASE (Connected, Autonomous, Shared, Electrified) domain.

It has engineering centers in 13 countries across 25 locations like Europe, the USA, Japan, China, Thailand, and India. Its clientele includes BMW, Eaton, Cummins, Paccar, Lafarge, GM, DICV, etc.

History:

KPIT was co-founded in 1990 by Ravi Pandit and Kishor Patil as KPIT infosystems.

In 2002, the IT department of Cummins has merged with KPIT. The merged entity was later renamed KPIT technologies in 2013.

In Jan 2018 Birlasoft and KPIT merged with each other and spun off into 2 companies where the entire IT business would come under Birlasoft and the automotive business would come under KPIT.

It entered the public markets in 2019 and the issue was oversubscribed by 50 times.

So what does KPIT do?

A modern car is estimated to have software that has 100 million lines of code. Other features like autonomous driving software are estimated to take the count to 300 million lines of code.

As vehicles are getting increasingly smart with parts like Electronic Control Units (ECUs), sensors, and advanced chipsets, we need millions of lines of codes for these parts to work together and improve the efficiency of the vehicle. So do you know how software is eating into the car? Read it before going further.

Connected Mobility:

Having infotainment systems for entertainment, maps, diagnostics of the vehicle, over-the-air updates are all webbed together by Software. Software issues cost carmakers $17 billion a year, acc to ABI Research. Connected vehicle technology can reduce these costs.

Autonomous Vehicles:

Driver assistance features like Reverse Park Assist, Blind Spot Detection, Drowsiness Detection are becoming common features in cars. The software helps in improving safety and averting accidents along with the above features.

Shared Mobility:

Shared car services will constitute 26% of all global miles traveled according to Morgan Stanely. With aggregators like Ola, Uber, and Lyft offering mobility-as-a-service, software competency remains at the center of consumer experience.

Electric Vehicles:

EVs need sophisticated software for battery management, inverters, and varied charging standards across the globe. The cost of electronics as a % of the total cost of a car is expected to go to almost 50% in 2030. This is close to a 60% increase from current levels.

The automotive software demand is expected to grow at 14% in the next decade compared to global vehicle production that is estimated to grow at just 3-4%. KPIT is focusing on leveraging its expertise in mobility software and offering solutions for EVs.

The R&D spending on CASE ( Connected, Autonomous, Shared mobility, and EVs) by global top 10 spenders are said to be tripled reaching $61B during FY21-FY26. KPIT is a pureplay software automotive integrator that can help OEMs accelerate their R&D in CASE-related platforms.

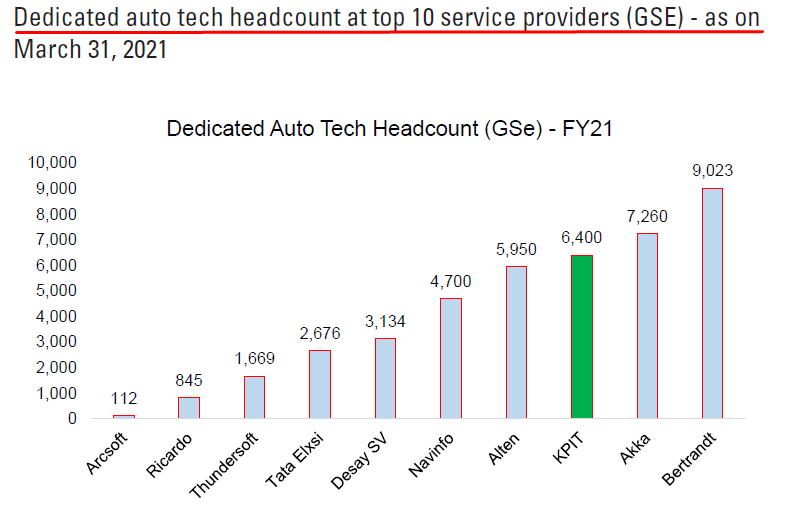

KPIT has 3rd largest auto tech talent pool globally and has experience in high entry barrier areas like L3-L5 autonomous driving, Battery management system and vehicle to anywhere connectivity.

KPIT is mainly focusing on 2 things.

how quickly and accurately can vehicle makers implement over-the-air updates to software-led features so that their products reach markets in time while ensuring they don’t lose market share or position?

how can vehicle makers ensure high quality, first-time-right delivery while keeping costs in check?

Before reading further, do consider subscribing to our newsletter so that you won’t miss out on any such insights around investing and Indian stock markets. Thank you for your support :)

Patents filed by KPIT across domain:

It has filed more than 40 patents to date and only 6 have been granted.

Hydrogen fuel cells in mobility:

Sentient Labs is an innovation hub incubated by KPIT Technologies. It is working along with Govt’s Council of Scientific and Industrial Research and National Chemical Laboratory to develop buses that run on hydrogen fuel cells.

Ravi Pandit, Chairman of KPIT tech said that the company is confident about the possibility of a hydrogen economy in India and the high efficiency of these buses. KPIT uses an aerobic microbial method to generate hydrogen. The company says that it is 25% more efficient than conventional hydrogen manufacturing methods.

Mr.Pandit is also confident about KPIT’s major role in the upcoming hydrogen revolution. Though KPIT does not want to be in the business of making hydrogen or hydrogen fuel cell buses, it will play a key role in the core technology.

Partnership with dSPACE and Microsoft:

Certification for autonomous vehicles requires millions of miles of testing, which is achieved through data-driven simulation. This requires multiple skills and tools to manage petabytes of data (e.g., domain expertise, software development capabilities, unique tools, and infrastructure).

KPIT Technologies, dSPACE, and Microsoft have teamed up to offer a unique solution for OEMs and Tier-1s seeking homologation (self-certification in the USA) for advanced driver assistance systems and autonomous driving.

While KPIT will work on the integration of applications for autonomous driving software development, virtual simulation, and validation tools for autonomous driving use cases. dSPACE will contribute tools and solutions for data-driven development, simulation, and validation. Microsoft Azure Core will provide cloud services and computing capabilities.

Other partnerships and Deal wins:

BMW: KPIT receives a large multi-year deal from BMW Group for software development, integration, and maintenance of a combined powertrain coordination unit including charging control. KPIT is also mentioned as an Autonomous driving partner in BMW’s investor results.

Triumph: KPIT develops one of the earliest technology solutions for Turn-by-Turn navigation based on Google maps for Triumph’s premium bikes. KPIT’s software platform enables 15+ models of Triumph with digitally connected experience across the globe that is safe and distraction-free through the ‘My Triumph Connectivity System’ application.

KPIT won a multi-million USD strategic deal for a European Automaker’s electrification program. The engagement pans in excess of 5 years and the deal value is estimated at USD 50+ million.

A leading Automotive Tier I and system supplier for Autonomous Driving and ADAS and a market leader in automotive safety electronics products has selected KPIT as their strategic software partner for Autonomous Driving, ADAS, and AUTOSAR domains. The engagement pans for 5 years and the deal value is estimated at USD 60+ million.

A leading European Car Manufacturer selected KPIT for multiple strategic engagements in the Electric Powertrain domain.

A leading European Car Manufacturer selected KPIT for a strategic program in the Autonomous Driving domain.

A leading American Car Manufacturer selected KPIT for multiple engagements in the electric and conventional powertrain areas.

A leading Asian OEM selected KPIT for a key engagement in the Autonomous Driving domain.

A leading Asian Cab Aggregator selected KPIT for a program in the Digital Connected Solutions domain.

Shareholding:

While Promoter Proficient Finstock LLP holds 32.41%, CEO and MD Kishor Patil holds 4.87% in KPIT.

DIIs include ICICI Prudential Life Insurance ( 4.32%) and Nippon India Small Cap Fund (3.80%)

Interestingly Massachusetts Institute of Technology holds a 3.11% stake in the company is one of the top 10 shareholders in the company.

Public hold 24.68% in the company

Mutual Funds have increased holdings from 10.73% to 11.34% in Dec 2021 qtr.

Management:

The top 10 employees Management in terms of remuneration drawn in an FY are as follows. The CEO and MD Kishor Patil draw remuneration of more than 2 crores along with whole-time director Sachin Tikekar.

While the average % remuneration of the employees decreased by 7% in the financial year, remuneration of directors and Key Managerial Personnel decreased by 40% owing to Covid.

The increase in the median remuneration of employees in the FY is 8%. The ratio of the remuneration of each Director to the median remuneration of the employees for the financial year is as follows

The amount of salary drawn and its ratio to median salary seems similar to CEO and MD Kishor Patil and Whole-time Executive director Sachin Tikekar. Wondering why he is paid as much as the CEO and MD is paid. Curious to know if he is expected to take over after Kishor Patil.

Awards:

Every year, Frost & Sullivan recognizes companies across a range of regional and global markets for their superior leadership and innovation in various categories. KPIT Technologies has been awarded the Global OTA and Cloud Platform Technology Innovation Leadership Award in 2021.

KPIT has 20 years of experience in the automotive and mobility domain and offered OTA(Over-the-Air) solutions for the last 7 years. KPIT has deployed OTA components in more than 5 million vehicles on the road to date and over 11 million additional OTA for customers’ vehicles are in pipeline.

Financials and Revenue mix:

KPIT reported revenue of ₹ 20,357 Million for the year FY21 compared to ₹ 21,562 Million in FY20. The EBITDA for FY21 stood at 15.2% i.e ₹ 3,101 Million compared to 13.2% i.e ₹ 2,954 Million in FY20. The Net Profit for FY21 stood at ₹ 1,461 Million.

KPIT started FY21 with a Net Cash Balance of ₹ 3,278 Million and ended the year with a Net Cash Balance of ₹ 8,224 Million with zero debt. It added close to ₹ 5.0 Billion during the year. That is more than 6 months of operations for KPIT. Almost 70% of the Net Worth of KPIT is represented by Net Cash. It shows the superior cash conversion cycle of the company.

Q2FY22 performance:

FY2022 Revenue growth outlook increased to 18% - 20% FY2022 EBITDA margin outlook raised to 17.5+%

Q2FY22 EBITDA at 17.6% as compared to 17.3% last quarter post full quarter impact of wage hikes

Net Profit for the quarter at ₹ 651 million as against ₹ 602 million last quarter, Y-o-Y growth of 134%, Q-o-Q, 8.1%

Q2FY22 reported revenue at USD 80.36 million, a CC growth of 4.8% Q-o-Q

Goldman Sachs expects KPIT to grow EPS by 29% annually over FY22 to FY25. It expects sales and EBIDTA to increase by 21% and 29% respectively in the same period. OEMs are starting to have bigger sales targets for EVs and this will act as an inflection point. The companies revenue mix is as follows:

Do watch this video to understand the growth plans of KPIT for the next few years and CEO and MD Mr. Kishor Patil’s thoughts on the business and Goldman Sachs’s report.

Looks like the market is pricing in the huge growth of the company due to multi-year contracts, a consistent increase in quarterly sales, and EBIDTA margins. The margins have increased from 14.355 to 17.61% in the last 5 quarters.

Mobility solutions in CASE (Connected, Autonomous, Shared, and Electric) account for more than 90% of KPIT’s revenues.

KPIT earns 41% of its revenues from the USA, followed by Europe (39%) and the Rest of the World (20%).

KPIT earns 75% of its revenues from passenger vehicles, followed by commercial vehicles (23%) and others (2%).

It earns the majority of revenues from Powertrain (34%), followed by AD-ADAS (Autonomous Driving- Autonomous Driver Assistance System) (23%), Connected vehicles (13%), and others account for the rest 30% of revenues.

Risks:

The company is operating in the automotive industry which is cyclical by nature.

KPIT’s top 17 clients account for 84% of its total revenues. This is a huge concentration risk.

High Attrition rates in the talent pool.

Currency fluctuation is another risk as the company’s major revenues come from the USA and UK. Appreciation of INR will be counter-productive for the company

Conclusion:

It will be a mistake if we consider KPIT as just an EV bet. Irrespective of a car being ICE or EV, it is certain that cars are getting smarter with each passing day. By 2030 50% of the cost in manufacturing cars will go to electronic systems. With features like Connected and shared mobility, Autonomous driving, and electrification going mainstream we need Billions of lines of code for these to work together.

Simply put, KPIT develops software that can intertwine these functionalities and integrate them to improve the car’s performance. It will help automakers to make over-the-air updates without the need of calling back units in case of defects. KPIT can help automakers enhance EV performance with software for battery management, inverters, and varied charging standards across the globe.

So far whatever we have read and understood about the company shows that the business seems secular with growth prospects as automakers are focussing on making their cars smarter and increasing their share of EVs.

The R&D spending on CASE ( Connected, Autonomous, Shared mobility, and EVs) by global top 10 spenders are said to be tripled reaching $61B during FY21-FY26. KPIT will likely be one of the biggest beneficiaries of this.

It almost feels silly that most of the businesses we read about are already trading at astronomical valuations and KPIT is not an exception. It has delivered close to 400% returns already in the last 1 year. It has run up too fast in the last few months. It is up by 12.8% year to date. We would like to keep tracking the company for time being.

This write-up is for educational purposes and not investment advice. Do your own research before buying.

Happy Investing!

Peace,

May27 Capital.

Great insights. KPIT is a buzz among investors community recently, this article validates that.