About the company:

Nykaa is an Indian e-commerce platform founded by Falguni Nayar in 2012. It sells beauty, wellness, and fashion products across websites, mobile apps, and 76 offline stores for men and women. Nykaa is betting big on digital content that includes product reviews, e-beauty magazines, expert articles, and how-to videos on beauty. The brand name Nykaa is derived from the Sanskrit word nayaka, meaning ‘one in the spotlight’

Falguni Nayar was former MD at Kotak Mahindra Capital before starting Nykaa. Her husband Sanjay Nayar is the former CEO of PE major KKR. The Nayar family collectively owns a 54% stake in Nykaa. It counts Steadview capital, Lighthouse India, Fidelity investments, Sunil Munjal of Hero group, Mariwala family (Marico group) as its investors. Bollywood stars Alia Bhatt and Katrina Kaif also invested an undisclosed amount in Nykaa. It attained unicorn status in 2020.

Nykaa has over 1,300 influencers and 12.6 million followers across social media channels. Unlike other startups that are burning a lot of cash upfront, Nykaa has turned profitable in FY21. Nykaa reported a profit of INR 61.9 Cr in FY21. Total income increased by 38.10% and stood at 2,452.6 Cr rupees compared to 1777.8 Cr in FY20. The average order volume spiked by 35%.

Industry:

India’s per capita income grew at 7.3% CAGR between 2015-19 compared to the USA (3.8% CAGR) and China (7%), as per the world bank. An increase in per capita income may lead to rising in consumption.

India is one of the youngest nations with a median age of 28 years, 375 million GenZ (10-24 yrs), and 333 million millennials (25-39 yrs). That is 51% of the entire population. They are the biggest spenders and are likely to spend more with an increase in earnings.

India has 2nd largest urban population in the world. 35% of the population live in urban areas that have greater purchasing power with opportunities.

Smartphone penetration, cheap internet, and adoption from tier-2 and tier-3 cities may increase and India is expected to have 970-1000 million internet users by 2025. India currently has 150-180 million shoppers in India.

India Retail Industry:

India’s retail market size stood at ₹63 trillion in 2019 with a CAGR of 11% over the last 3 years. It is expected to be a ₹91 trillion market by 2025. This growth is expected on the back of the rising middle class, soaring income levels, and increasing demand from Tier 3-4 cities and Rural markets.

Covid induced lockdowns led to a 14% decline in the market size in 2020. But it also helped E-commerce to grow by 1.6X from 3% in 2019 to 5% in 2020. E-commerce penetration in US and China is at 23% and 11% in 2019 indicating huge headroom ahead.

Fashion and Beauty-personal care accounted for 35% of discretionary retail space in 2020.

Currently, 89% of India’s retail market is unorganized with local shops, street vendors, and convenience stores. Rising income levels and digital penetration will help in the growth of organized retail.

Business of Nykaa:

Nykaa used to be an online-only platform for the initial 3 yrs and later switched to an omnichannel model. Now it operates through both online and offline modes to offer products. Nykaa has crafted a portfolio of 13 brands like Nykaa Cosmetics, Nykaa Naturals, Kay beauty, and twenty dresses. Nykaa has 2,045 employees, of which 47% are women as of 2021.

Nykaa offers 2 million SKUs from 3,826 national and international brands to our consumers across business verticals. SKU (Stock keeping units) are unique alphanumeric codes assigned to a product with different colors, shapes, and sizes. So, in a nutshell, they have close to 20 lakh varied product offerings. Nykaa’s mobile apps had 43.7 million cumulative downloads as of FY21. Nykaa has one of the highest share of app-led transactions in India.

Nykaa’s offline channel has 73 physical stores across 38 cities in India over three different store formats of Nykaa Luxe, Nykaa On Trend, and Nykaa Kiosks. Nykaa currently serves in 24,817 pin codes, covering 86.4% of the serviceable pin codes across the country. They have 18 warehouses, with a storage space of close to 6 Lakh sq. ft.

Business segments:

1) Beauty and Personal care (BPC):

Nykaa offers 197,195 SKUs from 2,476 brands across categories like make-up, skincare, haircare, bath and body, fragrance, grooming, and health and wellness. In FY21, 17.1 million Orders were placed on Nykaa’s platform for BPC products with a total GMV of ₹33,804.1 million, a 35.3% increase over the FY20.

India’s BPC market grew at 13% CAGR to ₹ 1,267 billion in the last 3 years. The market size was down to ₹1,120 billion in 2020 as a result of reduced spending during the first COVID-19 wave. it is projected to grow at a CAGR of 12% to ₹1,981 billion by 2025.

Men’s spending on BPC has been significantly lower than women's. Nykaa has launched Nykaa Men to address this market launching products across categories like shaving gels, shower gels, face wash, and body lotions.

Nykaa is targeting GenZ and Millennials through social media content, which accounts for 51% of the total population. Online channels accounted for 2% of the entire India BPC market in 2016. It grew at 71% CAGR in the next 3 years to 8% in 2020 i.e., ₹70 billion. If we look at the penetration levels of the US (15-20%) and China (25-35%), It is evident that India has a long way to go.

Nykaa Prive:

Nykaa has a consumer loyalty program where members can enjoy exclusive offers and discounts, complimentary gifts, free shipping, and access to members’ only exclusive content. Nykaa currently has more than 2.1 million Prive members. Consumers also earn reward points by signing up, shopping, writing reviews and answers, and referring new consumers to our platform. These rewards points can be redeemed to make purchases on our platform.

2) Fashion:

Nykaa launched its fashion segment in 2018 with a curated marketplace that offers products to women, men, and children across demographics. Nykaa offers 1,350 brands and over 1.8 million SKUs with fashion products across consumer divisions. 17.42% of fashion GMV is registered at 10% or fewer discounts, which shows that customers are ready to pay close to full prices of products. The average value of Orders on the Nykaa Fashion app and website stood at ₹4,034 for FY21. This is the highest among leading online fashion retail platforms in India.

The size of the Fashion Market in India stood at ₹4,186 billion in 2016. It grew at 12% CAGR in the next 3 years to ₹5,838 billion in 2019. But it declined by 35% due to Covid in 2020. It is projected to recover strongly and grow at 18% CAGR to ₹8,702 billion by 2025. Apparel is projected to continue driving approximately 73% of the market in 2025.

The Fashion Market in India is mostly unorganized and underserved with local apparel, footwear, and accessories stores. The organized segment of the fashion market grew from 29% in 2016 to 38% in 2019 and is likely to grow further.

Nykaa’s Target Market:

According to the RedSeer Report, Nykaa has a large BPC market opportunity of ₹1,120 billion growing at 12% CAGR to ₹1,981 billion in 2025. Our fashion opportunity of ₹3,794 billion is expected to grow at 18% CAGR to ₹8,702 billion in 2025. Nykaa has a total addressable market across beauty and personal care and fashion of ₹10,683 billion.

Nykaa’s Average order value for BPC products has increased from ₹1,433 in FY19 to ₹1,963 in FY21. AOV for the fashion vertical increased from ₹655 to ₹2,739 in the same period. Strangely, Nykaa has largely referred to data of 3 years from 2016 to 2019 in the DHRP. But the data on AOV is available only from FY20. Data of some more years would have given more clarity. The average order value across BPC products has been fairly stable initially and dropped in FY21. But it is interesting to note that the AOV of fashion has been increasing significantly QoQ.

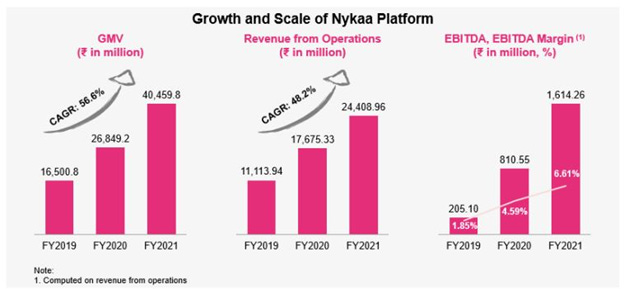

Gross Merchandise Value (GMV):

Gross merchandise value (GMV) is the value of goods sold on the platform. Though it is not a true representation of the revenues of the company, it gives insights into the company’s growth usage of the platform. Nykaa gets 86.7% of online GMV from its app. Total GMV has been growing consistently over the last three years, from ₹16,500.8 million in the FY19 to ₹40,459.8 million in the FY21, across beauty and personal care and fashion products.

The two most important things about Nykaa are Content and Technology:

Content:

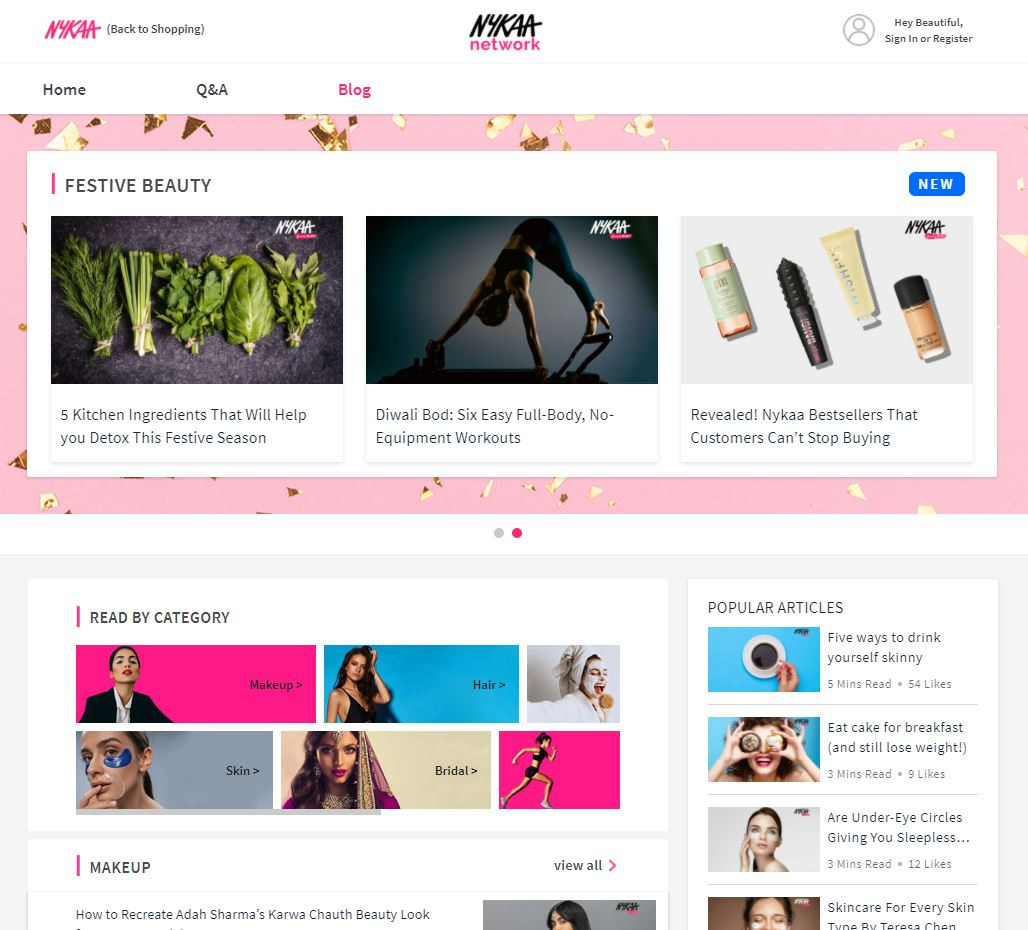

Nykaa believes that the Content-first approach is important for retail. In both BPC and fashion businesses, consumers often require assistance to navigate and make purchase decisions. Nykaa wants to simplify lifestyle commerce through influencer-led inspirational and educational transmedia content.

They create and film content in 7 languages with in-house through a team of beauty and fashion content creators called Nykaa Army. Nykaa has a network of 1,363 influencers, including Generation Z trendsetters, mommy bloggers, beauty, fashion, and lifestyle bloggers, makeup artists, and celebrities. Nykaa is attracting these influencers by paying commission for the sales they drive on our platform.

The company’s YouTube channel Nykaa TV has 1.1 million subscribers and a watch time of 1.3 million hours as of FY21. Content posted on Instagram and Facebook (including videos, reels, posts, and stories) was 39,498 posts. Nykaa has 12.6 million followers across leading social media platforms.

Nykaa has a peer-to-peer social community called the Nykaa Network with 3.1 million members who can interact with other beauty enthusiasts, ask, and answer beauty-related questions, give, and seek advice, and discover trends. Nykaa’s blogs Beauty book and Style files have published 598 articles in FY21.

Technology:

Nykaa’s technology platform is designed based on the ‘Service Oriented Architecture’ approach, consisting of 4 key components - applications, backend services, data, and security. In FY19,20 and 21, Nykaa spent ₹274.67 million, ₹345.57 million, and ₹401.16 million on technology. They expect to spend more on technology infrastructure in the coming years to handle traffic on app and websites.

The number of visits on Nykaa’s platforms has been steadily increasing over the last 3 years. The number of cumulative visits for the years FY19, 20, and 21 stands 378.0 million, 574.7 million, and 658.9 million at approximately. Visitors of beauty and personal care and fashion have spent over a total of 95.3 million hours on Nykaa’s platforms.

Nykaa Platform:

The below metrics suggest the steady rise in the number of visits by customers across Nykaa’s business segments BPC and Fashion. The number of visits almost doubled from 2019 to 2021. The monthly average unique visitors have increased from 9.1 million in 2019 to 13.5 million in 2021. To be honest, the number of visits to a website is not significant and the performance of a company cannot be fully analyzed with the no of visits.

But the unique transacting customers are those who end up buying something from the platform. It increased from 3.5 million in FY19 to 5.6 million in FY 21 for BPC and 2,637 in FY19 to 0.6 million in FY21 for Nykaa’s fashion vertical. Nykaa’s number of Orders in BPC grew from 11.0 million in FY19 to 17.1 million in FY21. The number of orders in the fashion segment grew from 0.4 million in FY19 to 2.4 million in FY21.

Awards and recognitions:

Acquisitions done by Nykaa:

In 2019 Nykaa has acquired the private women’s styling platform, 20Dresses.com in May 2019. It acquired another Indian fashion jewelry brand called Pipa Bella in 2021. The 3rd acquisition is a Kolkata-based skincare brand called Dot & Key on October 22, 2021, just around the IPO time.

IPO and objectives:

The size of the issue is ₹5,535 Crores with a price band of ₹1,085-1,125. The IPO will be launched between 28th Oct- 1st Nov. The IPO will have a fresh issue of shares worth ₹630 crores and an offer for sale of ₹4,722 crores. The retail quota is 10% of the total issue. 2.5 Lakh shares have been set aside for employees.

The promoters and early investors who will be selling their shares as part of the OFS are as follows:

Nykaa is planning to use the proceeds from IPO to do the following things:

The amount of outstanding fund-based loan facilities of Nykaa stand at ₹ 1,874.67 million. Nykaa intends to partial repayment and prepayment of borrowings for its subsidiaries.

Estimated investments worth ₹ 350 million to set up new retail stores with a built-up area of 75,000 square feet and warehouses with a built-up area of 3,50,000 square feet.

Enhance the visibility and awareness of Nykaa and its brands.

Competiton:

Though Nykaa has carved a niche out of the cosmetics, the ride ahead will not be smooth with a lot of competition from new-age startups and giants like Tata and Reliance. Tata group owns beauty brands like Studiowest and Skinn and wants to offer products through its super-app TataNeu.

Reliance Retail is focusing on acquisitions and partnerships in both cosmetics and fashion segments. It recently brought a 40% stake in Manish Malhothra’s MM Styles Private ltd. It has 40 partnerships with players like Turkish beauty brand Flormar, Italian cosmetics brand WOMO, Armani, Burberry, Diesel, Gas, Hugo Boss, and Tiffany & Co.

There are startups like Purple, Sugar Cosmetics, MamaEarth, mcaffeine, Myglamm, and Beardo ( Men’s beauty and personal care) ….the list is endless. With increased focus on having an in-house platform for selling their products, it is uncertain how long Nykaa can continue to be a marketplace alone. This is probably the reason it is investing more on in-house brands now.

Risks:

The top three categories in the BPC segment of Nykaa account for 71.3% GMV in 2021. Though this number has come down from 84.9% in 2019, the company still has concentration risk. If sales of any of these 3 categories get affected due to competition, pricing pressure, and demand and supply fluctuations, the revenue may drop drastically.

Advertising and promotional expenditures may increase to acquire and retain customers and incentives for influencers to retain content. Expenses stand at ₹1,428.27 million, ₹2,022.03 million, and ₹1,694.80 million for the years FY19,20 and 21. Nykaa has to make sure that advertising and promotion costs do not increase with time. The below graph shows that the expenses as a percentage of overall revenue are decreasing.

Counterfeit and illegal products: beauty products in Nykaa’s Mumbai warehouse were discovered by the Indian Food & Drug Administration and identified to be illegally manufactured by Bellezza Italia.

Nykaa outsources the manufacturing of their products to third-party manufacturers under loan and license arrangements or contract manufacturing. Nykaa also depends on 3rd part websites and search engines to drive customer engagement.

As much as Nykaa builds its business with help of content creators and influencers, any damage in these relationships or personal remarks and choices of the influencers can affect the reputation and thereby sales of Nykaa.

Promoters Falguni Nayar Family Trust has pledged 2.89% of Nykaa’s Pre-Offer Equity Share capital in favor of Infina Finance Private Limited against a total loan of ₹ 1,873.20 million availed by Falguni Nayar Family Trust, Anchit Nayar Family Trust, and Adwaita Nayar Family Trust.

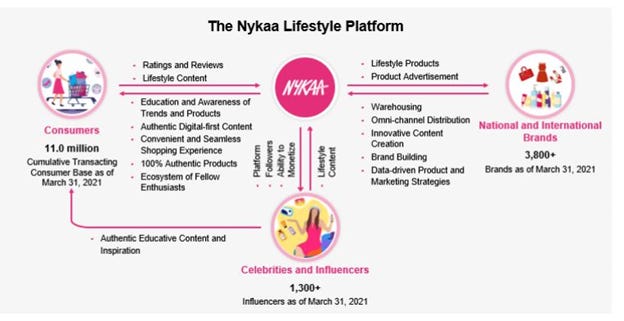

Management and Board of directors:

Falguni Nayar-Founder and CEO: She was former Managing Director Of Kotak Mahindra Capital Company, Falguni has received many accolades throughout her career and she is on several boards, including the Aviva Insurance Board, Dabur India, and as an Independent Member on the Tata Motors Board.

Financials:

Nykaa’s total GMV grew by 50.7% in FY21 to ₹4,045.98 crores compared to FY20.

Revenue grew by 38.10% from ₹1,111.3 crores in FY19 to ₹2,440.8 crores in FY21.

Profit stood at ₹61.9 crores compared to a loss of ₹16.3 crores in FY21.

EBITDA stood at ₹161.4 crores and EBIDTA margin stood at 6.61% in FY21.

The contribution of GMV sales in Tier 2 and Tier 3 cities increased from 56.9% in FY19 to 64.0% in FY21.

Nykaa’s revenue from the sale of services increased by 37.90% from ₹181.5 crores in FY20 to ₹250.2 crores in FY21 due to the growth in revenue from marketing support revenue and income from marketplace services.

Valuation:

A company’s prospects can be great. It can grow exceptionally fast. There can be tailwinds in the industry in which it operates. But we believe that in the end, it’s all about valuations. Our returns depend on how much we are paying for a business. Even if you buy an exceptional business at an insane valuation, you are likely to end up making mediocre returns.

In investing remember this simple thumb rule that the price of a stock will always follow the earnings. Nykaa first wanted to issue IPO at a valuation of $3 Billion. Then they changed it to 4.5 Billion and finally settled for $7.4 Billion. That is ₹55,000 crores.

So Nykaa is getting valued at a price to sales of 22X. Price to sales is Company’s market cap divided by the company’s sales or revenue in the past 12 months. In a nutshell, you are paying 22 rs for every single rupee of revenue the company generates. Amid all the positivity around Nykaa, it is expected to list at a huge premium which can further increase the valuation.

This metric alone has convinced us to stay away from subscribing to the IPO though we like the business. We would like to continue tracking it and keep an eye on the valuations post listing for now.

Thanks for reading through. We appreciate your patience and eagerness to learn. We are open to your feedback on how we could do better. Please do subscribe to May27 Capital and share it with your investor friends if you found this piece useful.

More resources to deep dive further:

Business and IPO analysis by SOIC.

Business analysis by Tar on Invest Karo India.

Very well curated and I concur with your observation. The valuations are insane and that's obvious as they are in the business of making money with minimal care for retailers.